Surviving SVB: A Founder's Firsthand Account Of Decision Making During A Crisis

What it was actually like navigating an unprecedented situation: potentially losing all our capital due to a bank run.

These last few days have been some of the most stressful in my professional life.

Why? My startup, Hoop, had all of our capital in a bank that represented a stable, solid choice in the tech community for years: SVB.

My co-founders Brian, Justin and I have had to make a series of business altering decisions in snap moments over the last few days. Since we’re a startup whose mission is to help teams make better decisions faster, I wanted to share a behind the scenes account of what it’s been like.

Thursday Mar 9, 2023

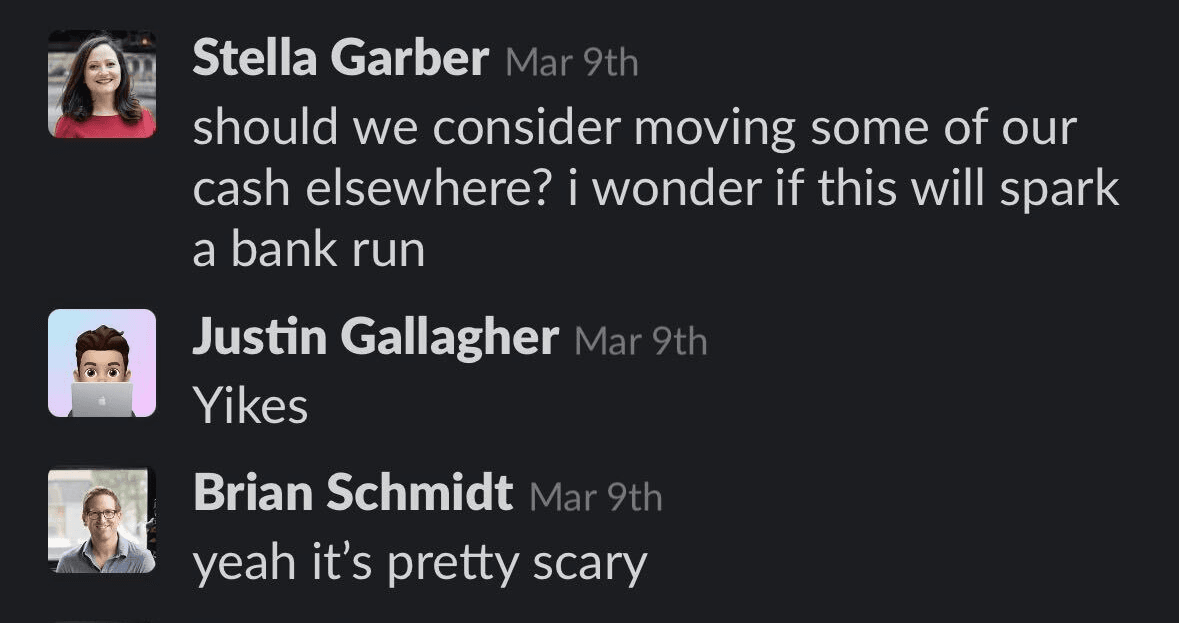

At 11:52 AM CST, my cofounder Brian posted an article in Slack about an issue at SVB. My heart rate went up, but not too much. Here’s the initial convo:

I quickly pinged some other friends in the tech industry to see if they’d heard anything. Most hadn’t. One said “Move your money from SVB into treasury bills today.”

I went into our weekly team meeting at 12:30 PM CST with a sense of panic, and foreboding dread. We went through the meeting without showing emotion, but all around we started getting emails from others and seeing social media blow up: Something was happening at SVB, and we needed to get our money OUT.

But where to? Nobody tells you to open more than one business bank account when you launch a startup. Maybe this will be common wisdom moving forward, but it was not something we were told. We quickly reached out to many banks to see where we could open a bank account the fastest, racing to beat the 5 PM EST wiring cutoff. We missed it.

By 4:52 PM EST, we had a bank account open with Mercury Bank, a startup bank that moved the fastest. We were told Chase would open a bank account the next day. The next question was whether we felt it was safer to wait for the Chase account, or just make the move to Mercury.

In these moments, I can honestly say that the amount of panic, uncertainty, and information asymmetry we faced was unprecedented. We tried to use all the decision making tools and processes in our toolkit but in a moment of great stress, the things that mattered most were the trust we’d built up as partners, and execution speed.

By 9 PM, we had initiated a wire to Mercury bank and all felt relieved.

Friday Mar 10, 2023

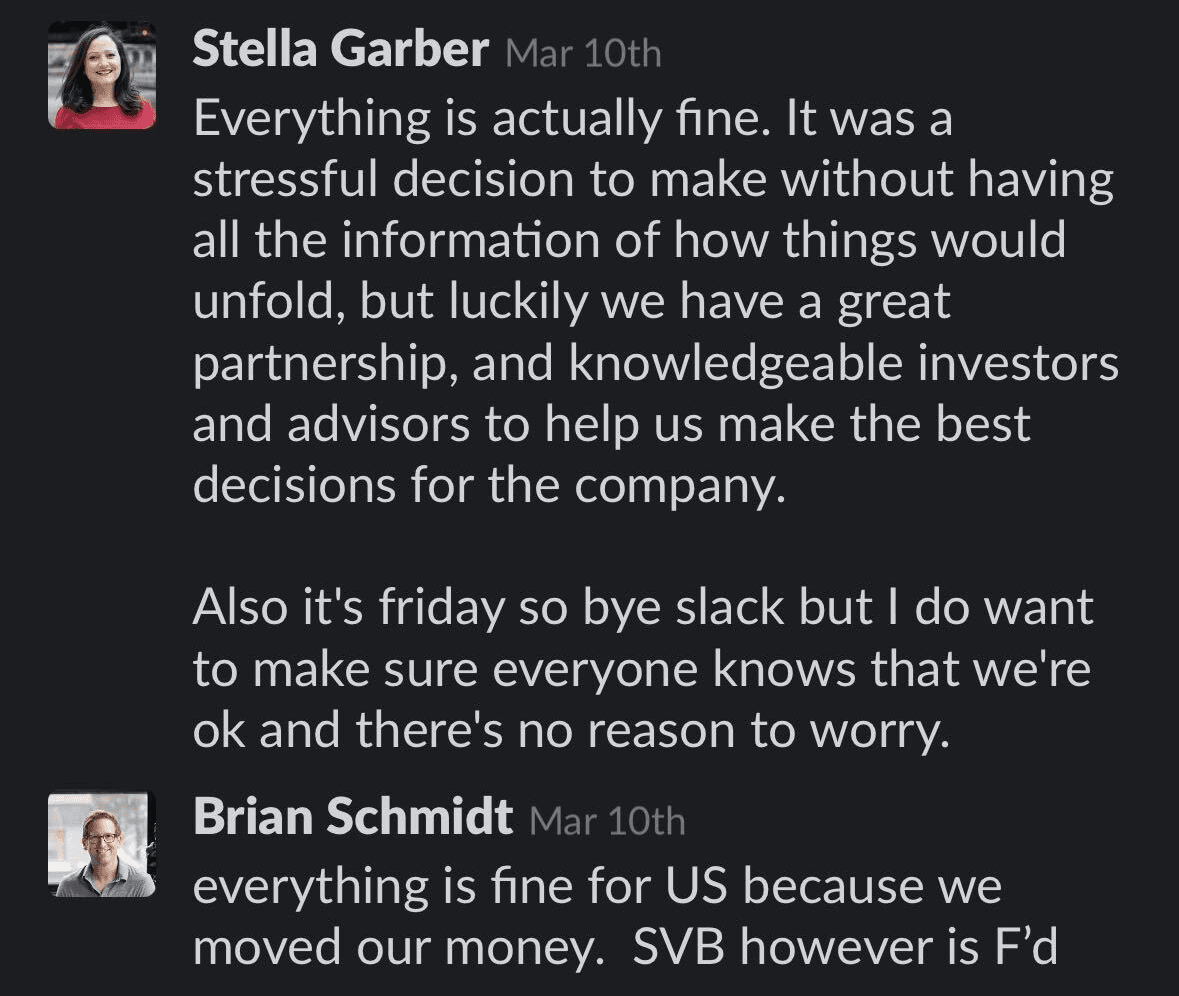

On Friday morning, we sent the following messages to our team in Slack. Since we observe a 4 day workweek, we don’t usually use Slack on Fridays, but clearly this was an exception:

Thirty minutes later, we got a notification that SVB failed.

It felt like a punch to the gut. We could see that a wire was initiated out of SVB, we could not see any inflow into our new bank account. Our money, the lifeblood of our startup, was in some sort of banking purgatory between a newly failed bank, and a neobank that we were trusting with everything.

The next few hours were a blur. We began to send and receive frantic texts, and we were all glued to Twitter. We called every professional services provider we had access to. We got into a Zoom and decided two things:

- We should email stakeholders and let them know what’s going on.

- We should create a community for other founders to share information and experiences.

We did both of those things, while constantly refreshing every email, text, Slack, everything. The Chase account did not materialize as expected. Payroll was meant to process Monday morning and we didn’t know what was going to happen. It was chaos.

The positives were the way we were approaching this nightmare scenario. In times of trouble you find out the true character of people, and it was amazing to see all the support we got, not to mention the strengthening and testing of the cofounder bond. We remained as calm as we could, using strategies like:

- Being solution oriented- Stopping any train of thought that was focused on the past, and instead focusing our energy on the present.

- Generating as many outcomes as possible - We worked sync and async to come up with as many creative solutions as humanly possible.

- Reaching out to others- We engaged a wide group of people to share knowledge and help us make the best decisions.

Saturday PM and Sunday AM

With every new Tweet or news alert, we tried to glean information on what to expect. Would our wire clear on Monday? Did it depend on a buyer for SVB? Were insured deposits the only thing we could expect to access? Would transfers initiated before the receivership clear? Could we trust the Tweet from the guy who physically went to SVB and got info from an FDIC employee standing outside?

So many questions, but few answers and even more speculation. We tried to stay focused on the facts, and be in touch with each other in case there were developments.

By Sunday morning, we decided to run some scenarios on what might happen and what we’d do in each situation. We tried to focus on what we could control.

In a Zoom call, we listed out every scenario, something like this:

- SVB gets acquired tonight. Access FDIC insured funds tomorrow- What do we do?

- No acquisition tonight. Can’t access funds Monday AM- What do we do?

- Policy resolution tonight. Access all capital on Monday AM- What do we do?

Sunday Mar 12, 2023 at 5:16 PM CST

My phone blew up. My husband ran into the kitchen as I was making dinner for the family and read the news: All would be ok, the Fed was taking action to secure all deposits (insured and uninsured) for not only SVB customers, but all present and future depositors.

Stakeholders were texting, everyone was breathing a collective sigh of relief. We would make payroll. We would have access to our funds the following day. We could continue on our entrepreneurial journey with confidence in the banking system.

I can’t describe the feeling of relief and pure joy I felt in those moments. Being a founder is hard enough without taking into account all the things you can’t predict…like pandemics and bank runs.

The other feeling was being part of a community where people cared about each other and the collective good outcome for our companies. It was going to be OK.

Me about 2 minutes after the Fed news on Sunday. Extreme joy!

Me about 2 minutes after the Fed news on Sunday. Extreme joy!

Monday Mar 13, 2023

On Monday morning, there were butterflies as we all attempted to log into SVB and initiate a wire transfer. Turns out, the frantic wire we sent out on Thursday was never initiated. We waited a few hours and began to see our money transferred to new accounts.

Our brains switched from active survival mode back to building mode. It was time to return to the job we had signed up for: building a startup.

We are the lucky ones. There are still founders who are having issues accessing their capital and trying to understand the status of loans and other venture debt. There are international clients dealing with long delays and uncertainties about what to come. My heart goes out to these entrepreneurs, and I hope they are able to move forward quickly as we were.

Reply like an expert. Every time.

Zero setup. Zero training. Just connect and let Hoop learn.